Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you’ve ever dabbled in personal finance, chances are you’ve heard of the envelope system. It’s one of the OG budgeting methods, made famous by the legendary Dave Ramsey and beloved by cash-conscious folks everywhere.

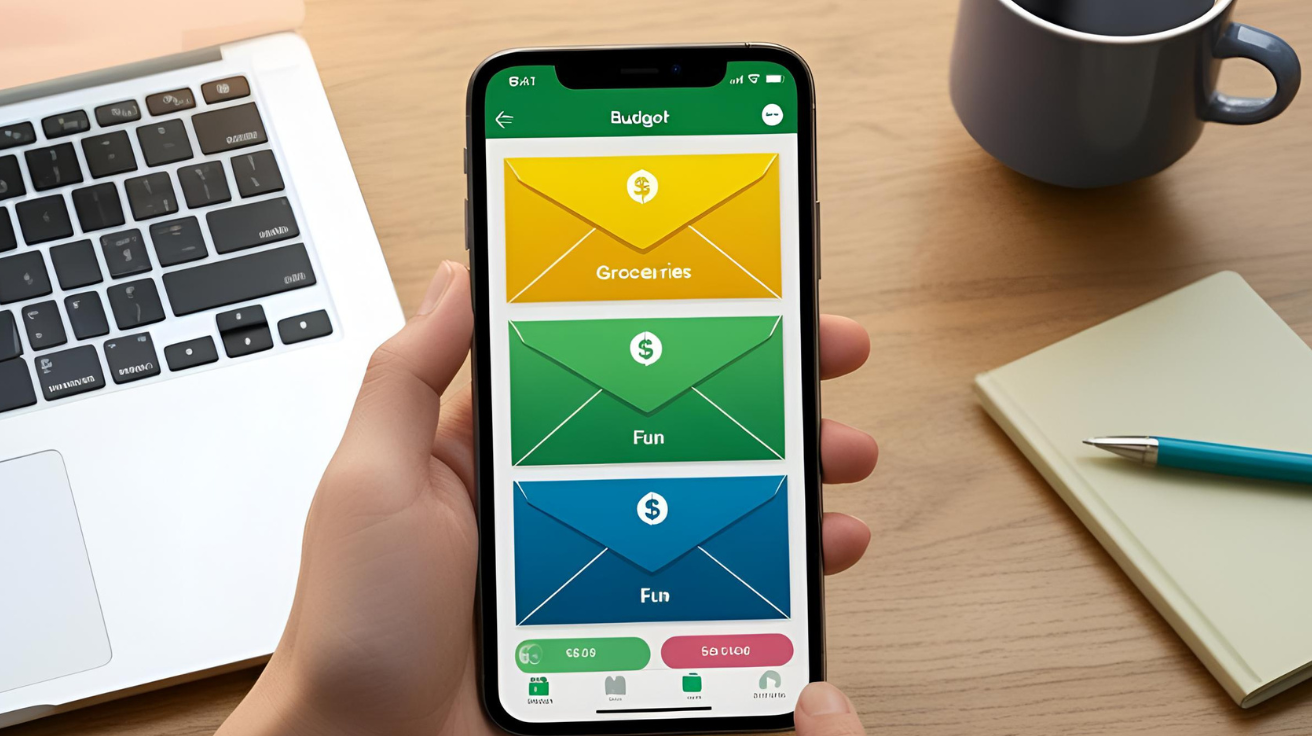

The concept is simple: assign every dollar a job by putting it into labeled envelopes—one for groceries, one for gas, one for fun money, and so on. When the envelope’s empty, you’re done spending in that category.

It’s brilliant… but we’re living in 2025. Most of us don’t use cash for anything anymore. So does that mean the envelope system is dead?

Not even close.

Today, I’m going to show you how to bring this classic budgeting method into the digital age—no cash (or paper cuts) required. Whether you’re a tech junkie, an app minimalist, or just looking for a way to get your spending under control without stuffing bills into envelopes, this one’s for you.

Let’s back up for a sec. Before we go full digital, here’s why the envelope system is so effective in the first place:

So the challenge is: how do we get all those benefits… without the actual envelopes?

Spoiler: it’s totally doable. Let’s talk cash-free strategies.

Just like the old-school method, start by breaking your spending into categories. These will be your “digital envelopes.”

Common categories:

The trick here is to keep it simple. Too many categories = chaos. Aim for 5–10 core ones that really reflect your life.

Here’s where the magic happens. Instead of physical envelopes, you’re going to use one of these digital alternatives:

Some online banks (like Ally, Capital One 360, and SoFi) let you create multiple savings “buckets” or spending accounts within your main account. It’s basically the envelope system—just with swipeable convenience.

You can name them anything you want: “Groceries,” “Fun Money,” “Rent,” “Emergency Fund,” etc.

How it works:

This method feels almost exactly like the original envelope system, except way less clunky.

Some apps are literally made for this. Two big ones to check out:

These apps keep you accountable without needing a pile of cash on your counter.

If you’re super disciplined (or want a physical boundary), you can take it one step further:

A little more work, but super effective for impulse spending.

Now it’s time to get practical.

Every payday:

This step is the heart of the envelope method. The goal is to stop guessing and start assigning every dollar a role.

Even with tech on your side, you’ll still want to check in regularly. Budgeting isn’t a “set it and forget it” thing—it’s a living, breathing part of your financial life.

You’re not trying to be perfect—you’re just getting better at understanding your habits and making more intentional choices.

Still not convinced this can work without paper envelopes? Let’s look at what makes the cash-free version just as powerful:

When your grocery “envelope” is digital and separate from your dining out “envelope,” you’re less likely to overspend. It’s all about setting limits that are visible and firm.

Even if you’re using a simple app or bank with multiple accounts, just seeing your available balance per category makes you pause and think.

By separating your money and watching those numbers drop, you’re creating a digital version of that real-cash feeling. It’s enough to make you question that $15 impulse buy.

Dana works a 9-to-5, gets paid bi-weekly, and wants to stop feeling broke at the end of the month. Here’s how she uses the cash-free envelope method:

In 3 months, Dana has $300 in savings and way less anxiety around money.

Here’s how to make the cash-free envelope system actually stick:

The envelope system isn’t about saying “no” to everything fun. It’s about saying “yes” to the things that actually matter to you.

Whether you’re saving for a dream trip, trying to pay off debt, or just want to feel a little less stressed when rent’s due, the digital envelope system is your low-stress, high-impact path to financial success.

You don’t need stacks of cash or envelopes shoved in a drawer to budget like a pro. All you need is a system, a little consistency, and a goal worth working toward.

Here are 10 genius hacks to save money fast.